|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

FHA Cash Out Refinance Closing Costs Explained for HomeownersFor many homeowners, understanding the complexities of FHA cash out refinance closing costs is crucial when considering refinancing options. In this guide, we'll explore the different components that contribute to these costs and offer insights to help you make informed decisions. Understanding FHA Cash Out RefinanceThe FHA cash out refinance allows homeowners to replace their existing mortgage with a new one, borrowing more than they currently owe and taking the difference in cash. This can be a strategic financial move for those looking to pay off debts, fund renovations, or cover other expenses. Benefits of FHA Cash Out Refinance

Components of Closing CostsWhen pursuing an FHA cash out refinance, it's important to consider the various components of closing costs, which typically include:

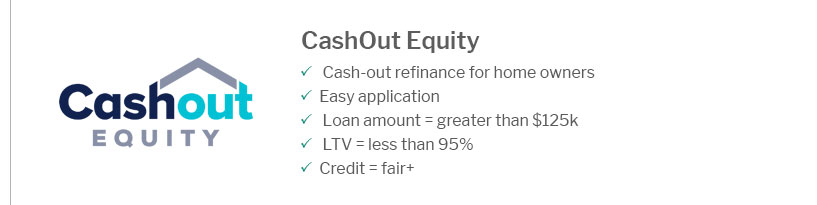

For more details on loan-to-value considerations, visit cash out refi ltv limits. Factors Influencing Closing CostsSeveral factors can influence the total closing costs associated with an FHA cash out refinance: Property LocationDifferent states and municipalities may have varying fees and taxes, impacting the overall costs. For instance, understanding how these costs vary in specific areas, such as Utah, can be critical when evaluating cash out refinance rates utah. Loan Amount and TypeLarger loans often come with higher closing costs, as fees like origination and appraisal are often percentage-based. Tips for Reducing Closing Costs

Frequently Asked QuestionsWhat is included in FHA cash out refinance closing costs?Closing costs typically include origination fees, appraisal fees, title insurance, escrow fees, and recording fees. Can I roll closing costs into my FHA cash out refinance loan?Yes, some lenders offer the option to roll closing costs into the loan, increasing the total loan amount. How can I reduce my FHA cash out refinance closing costs?You can reduce costs by shopping around for lenders, negotiating fees, and considering a no-closing-cost option. https://www.rocketmortgage.com/learn/fha-cash-out-refinance

A cash-out refinance is a way for homeowners to both refinance their mortgage loan and pocket a lump sum payment of cash at the end of the process. https://refi.com/fha-cash-out-refinance/

Costs can vary by lender and location but typically run between 3% and 6% of the financed amount. This includes the FHA's 1.75% UFMIP, as well as other standard ... https://www.youtube.com/watch?v=5QRGlTGgP8g&pp=ygUMI2ZycmVmaWFybWF4

Dive into the world of cash-out refinancing with FHA mortgages in this video! Explore the ups and downs of unlocking your home's potential ...

|

|---|